LEVERAGING SCIENCE,DEVELOPING INNOVATION

CharacteristicsofDepreciation

inCommercialandMulti‐FamilyProperty:

AnInvestmentPerspective

By:

Sheharyar Bokhari &DavidGeltner

MITCenterforRealEstate

Thisversion:March,2014

PresentationPreparedforthe

PensionRealEstateAssociation

SpringMeeting,Boston,May14,2014

Depreciationfroman“InvestmentPerspective”…

“Depreciation”=“Long ‐termpermanentdeclineinpropertyvaluenetofgeneral

inflation,associatedwithbuildingage,causedbystructureobsolescenceevenafter

expenditureonroutinecapitalmaintenance.”

“Obsolescence”=“Physical”,“Functional”,or“Economic”…

“InvestorPerspective”=“Fundamentalimpactofdepreciationoninvestment

performance”

Economic(notaccrualaccounting)perspective

Focusedoncashflows&marketvalues(not“bookvalues”)

CompatiblewithIRRorHPRmetricsofinvestmentperformance

Declinerelativetopropertyvalue notjust

structurevalue

(though attributabletostructureobsolescence)

Notsameastaxpolicyperspective(thoughrelated).

Studyfeatures:

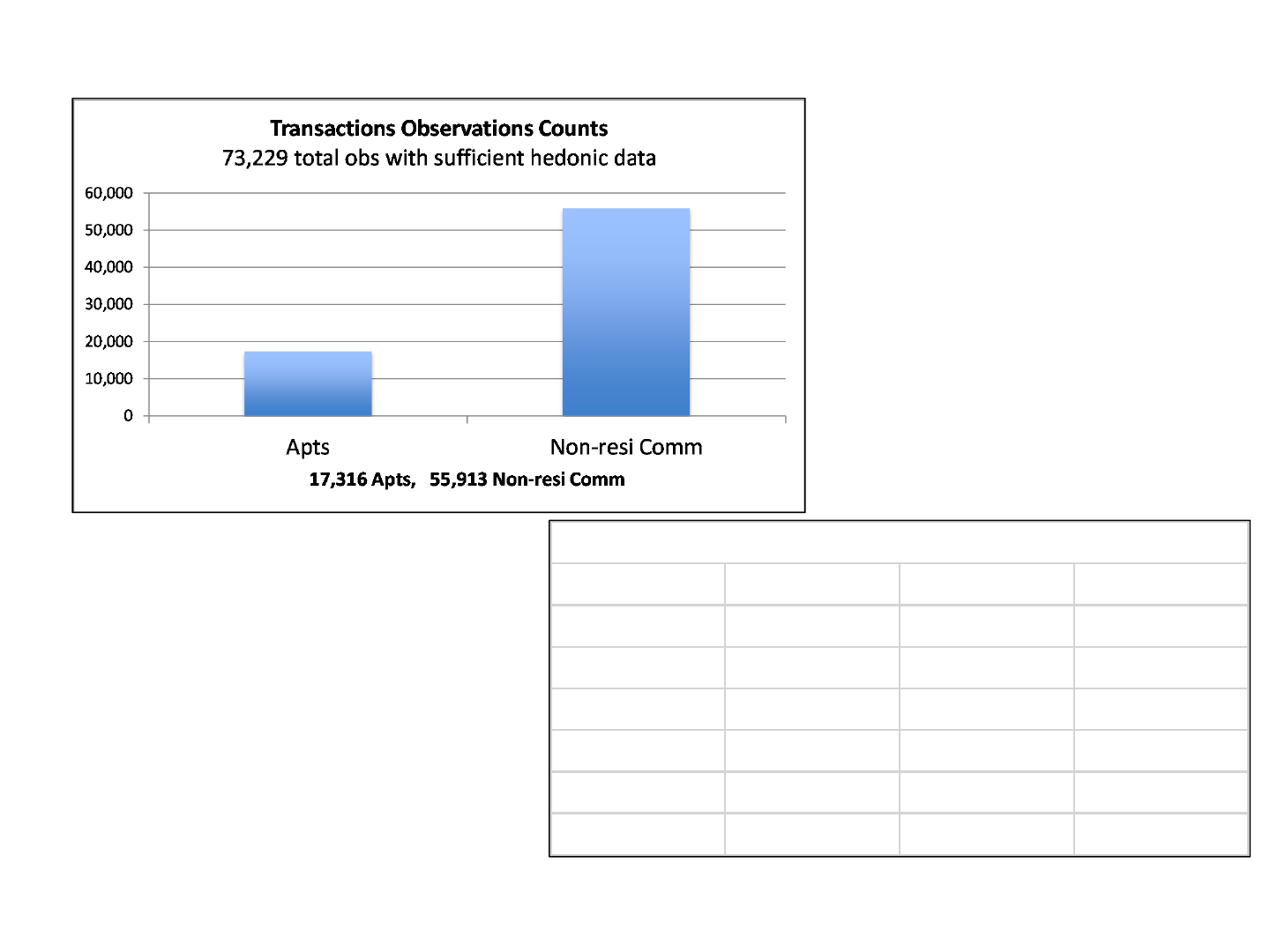

Largermorecomprehensivedatabase:73,229obs 2001‐13,

sales>$2.5M,fromRCAdatabaseof investmentproperties.

Basedonactualtransactionpricesnotappraisalsorassessments.

NOIeff ectvs“capratecreep”effect.

Causeofdifferencesacross

metros.

Whydoesdepreciationmatter?...

• Affectsthecapitalreturn(hencetotalreturn)ofCREinvestment

• RealdepreciationisubiquitousinCREinvestmentproperty,anditisnon ‐

trivial(Wefindcloseto150bps/yr includingland value ≈25%assetval).

• Butitisoftenignoredinmicro‐levelDCFvaluationanalysisofinvestment

property:

• Typical

pro‐formaautomaticallyprojectsrentalgrowthof“3%”,

vaguelybasingthatoninflation(eventhoughactualinflationis

probablylessthan3%),notrecognizingthatrealdepreciationmeans

thatrentsarelikelytogrowlessthaninflation.(Theoffsetisthe

typicalproforma appliesadiscountratethatisunrealisticallyhigher

than

actualexpectedIRR.)

• Andrealdeprecationhas“characteristics.”Itvariesacross:

• Metromarkets(relatedtospacemkt supply elasticity)

• Typesofproperties

• Ageofthebuiltstructureontheproperty

• Propertymarketconditions

• So,depreciationisimportantforinvestorstounderstand…

Measuredepreciationby“usedassetvintageprice”method:

Usehedonicregressionmodel:

Ln(Price/SF)=f(PropertyAttributes,TransactionInfo,LocationControls,Time

Dummies)

• PropertyAttributes=PropertyType,LnSqft,Age,Age

2

,cbd_fg

• TransactionInfo=SellerType,resolveddistress_fg,cmbs_fg,leaseback_fg,

excess_land_potential_fg

• LocationControls=RCAMetroAreadummyvariables

InthisspecificationAge&Age^2coefficientscapture

essentiallycross‐sectional variationinpriceasafunctionof

buildingage,i.e.,ageasofagiventime(timeofsale).E.g.,How

muchless30‐yr‐oldBldg Asellsforcomparedtootherwise

identical20‐yr‐oldBldg Basofthesamepointintime.Hence:

“real”(netofinflation)depreciation.

Alsonote:thisisdepreciationnet ofroutinecapital

expendituresontheproperties(whicharenotcontrolledfor).

Similarhedonicmodelofcaprates:

StandardizedCapRate =f(HedonicVarbs,TimeDummies)

Hedonicvarbs:

Age,Age^2,

LnSqft,

cbd_fg,

resolveddistress_fg,

cmbs_fg ,

leaseback_fg,

excess_land_potential_fg,

SellerDummyVars

PropertyType,RCAMetroDummies

Where:StandardizedCapRate =CapRate – AvgCapRate(byMetro& Year)

InthisspecificationAge&Age^2coefficientscapture

essentiallycross‐sectional variationincapratesasafunctionof

buildingage.Systematicvariationincapratesacrossmarkets&

acrosstimearecontrolledforbythestandardization.

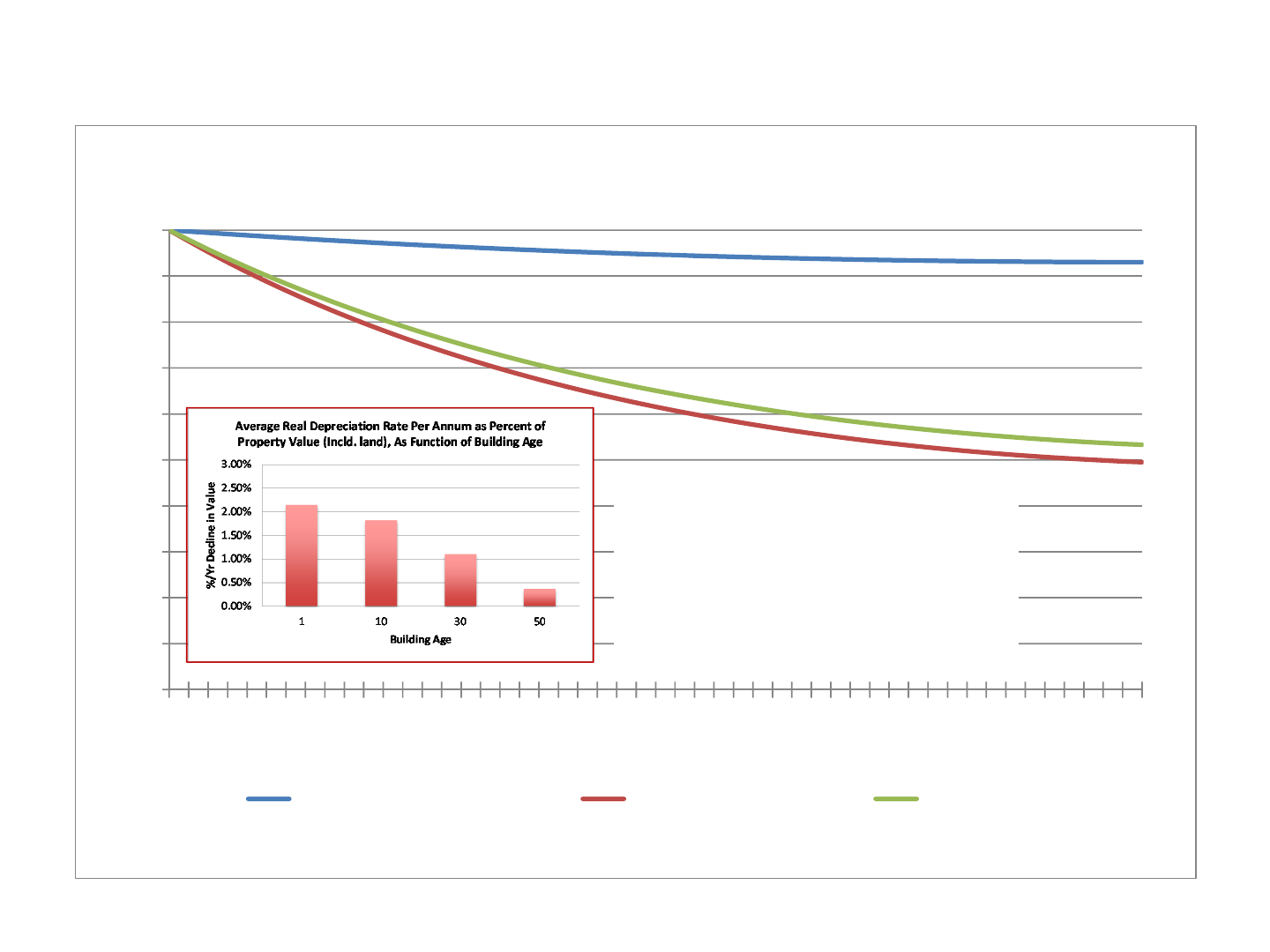

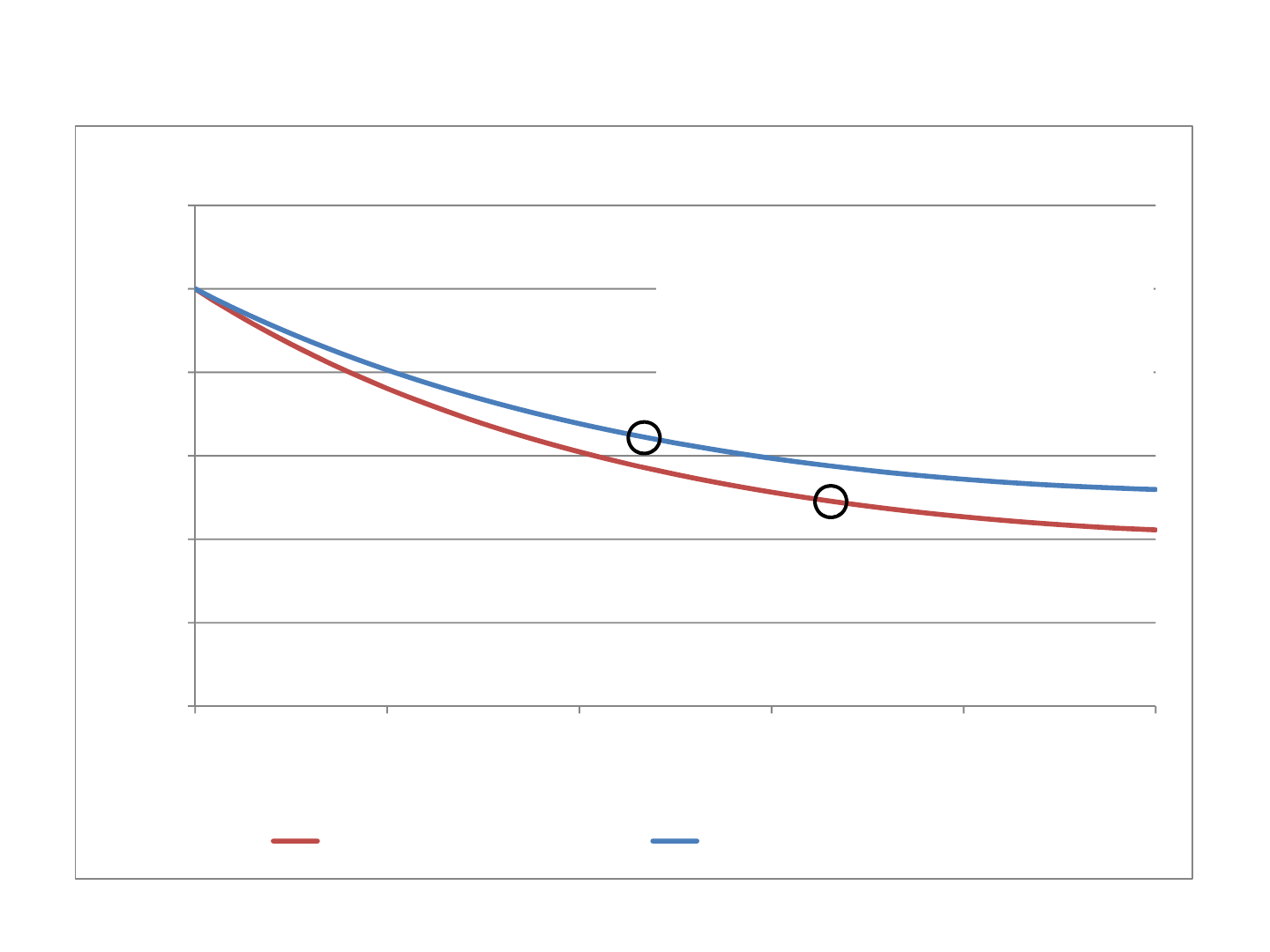

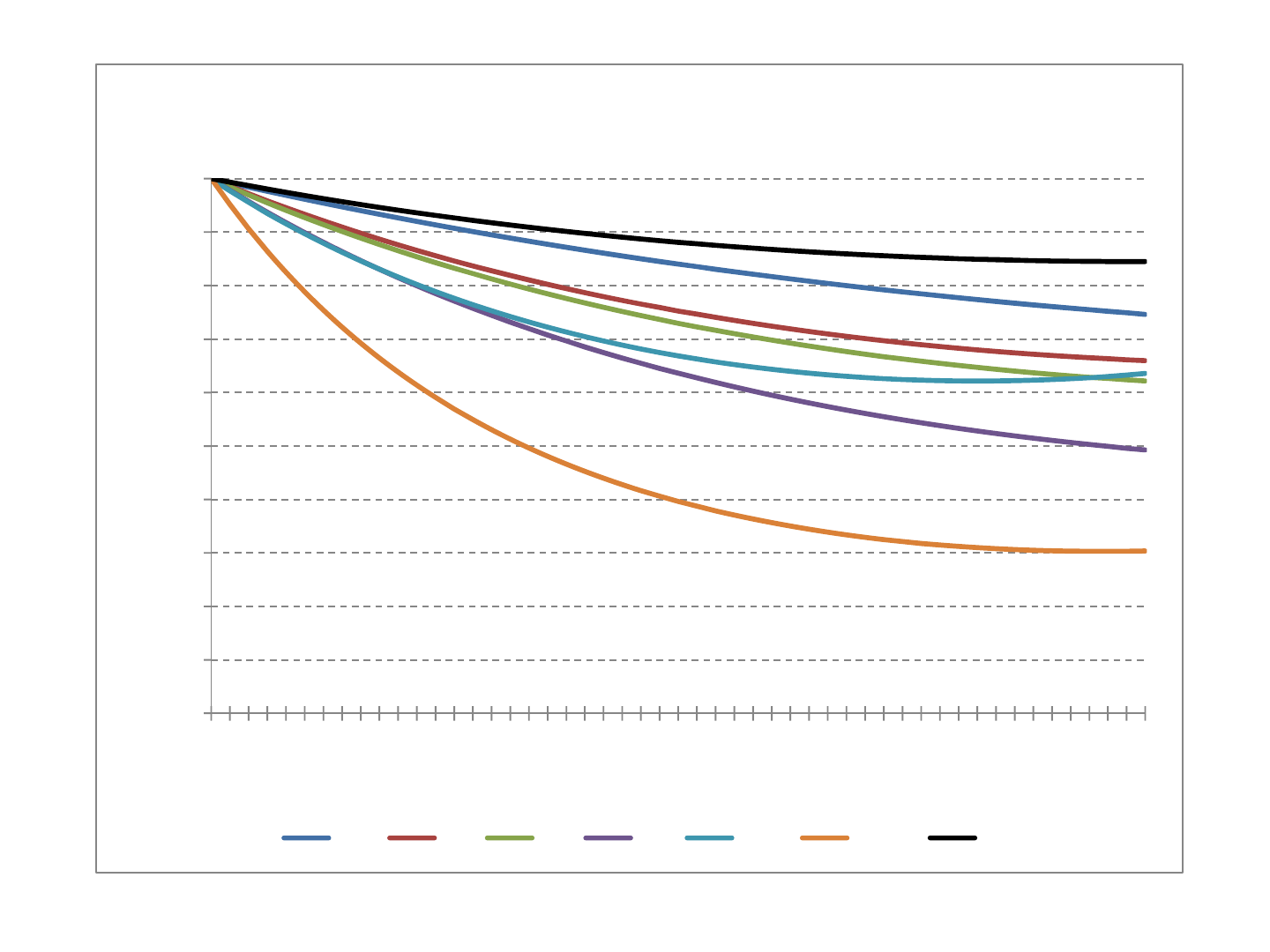

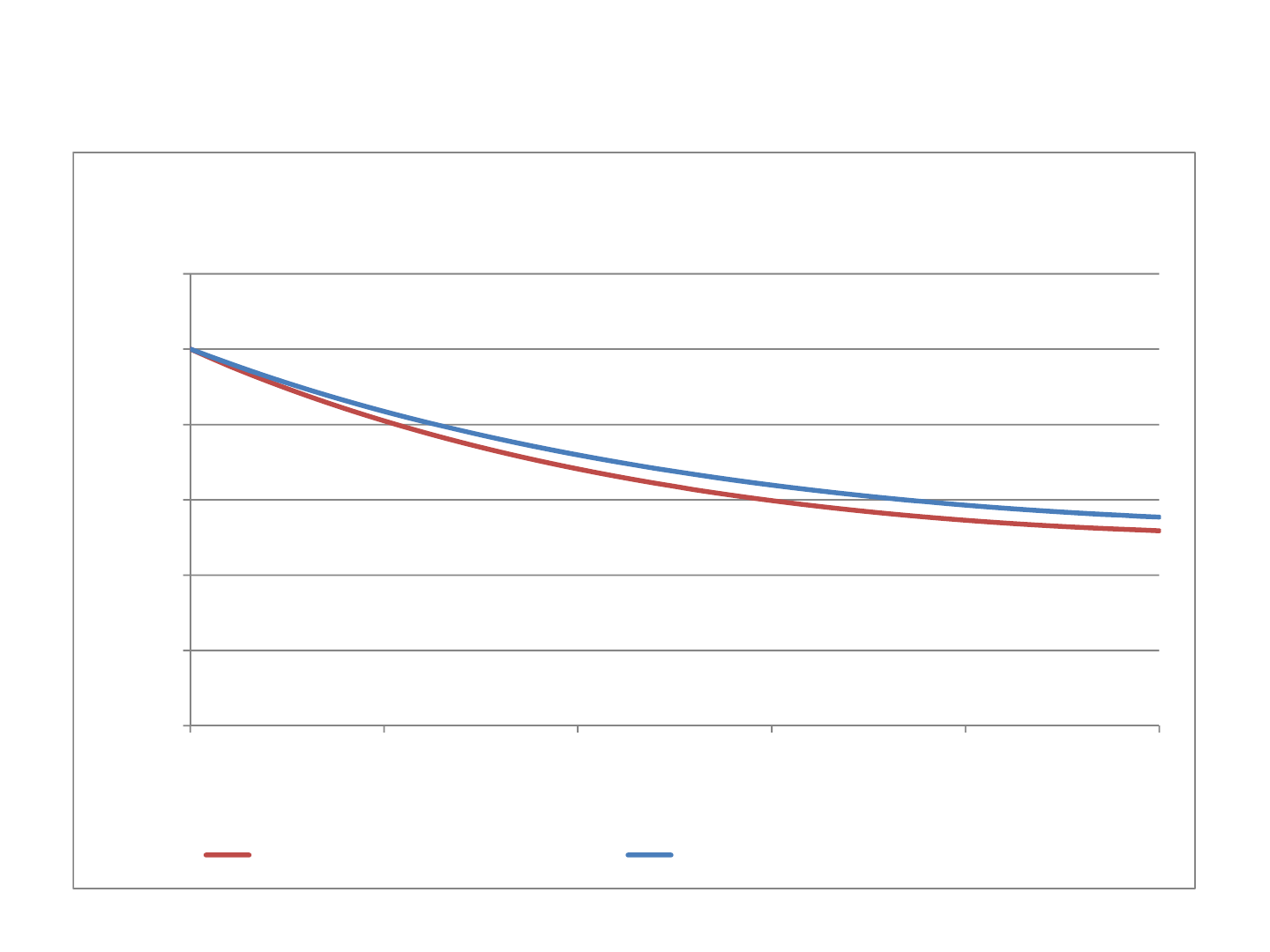

RealDepreciationinU.S.CommercialProperties

MostlyduetoNOIdecline(onlyslightlytocapratecreep)

Resultsforthenationalall‐propertysample,73,229transobs,Price&Caprate modelstogether…

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

0 1020304050

RatiotoZero‐AgePropertyValue

PropertyAge(yrs)

CumulativeEffectofRealDepreciatononPropertyValue(includingland):Dueto:

NOIEffect,CapRa te Effect,TotaloftheTwo

DuetoCapRateEffect TotalDepreciation DuetoNOIEffect

BasedondatafromRealCapitalAnalytics,Inc. forallU.S.commercialproperties>$2.5Mvalue

“NOI Effect” reflects some combination of lower rent, lower avg occupancy, or higher operating expenses.

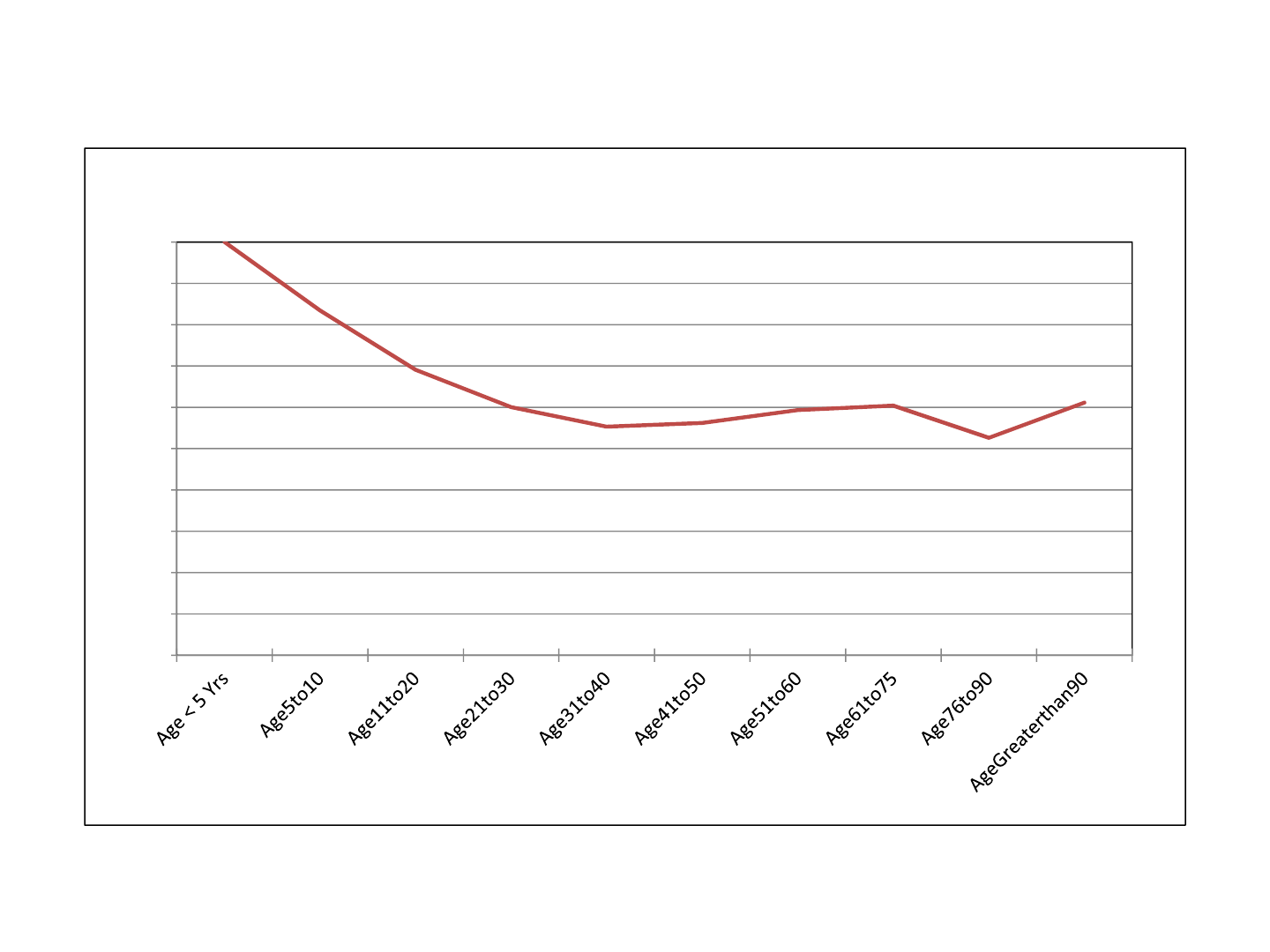

Overallnatl average=1.3%oftotal

propertyvalueperyearduringfirst50years

sincebuildingconstruction.Younger

propertiesdepreciatefaster,probably

mostlybecausebuildingstructureissmaller

fractionofolderproperties’values.

1.62%

1.51%

0.11%

Magnitudeofrealdeprecation:

• Overallaveragerate:1.3%oftotalpropertyvalue(inclu land)peryear(basedon

medianpropertyage).

• E.g.,ifrealdeprec =1.3%andinflation=2.5%thenobservednominalincreasein

same‐propertypriceis2.5%‐ 1.3%=1.2%/yr onavg.

• Fasterdeprec rateinpropertieswithyoungerbuildings,mostlyduetodeclineof

structureproportionoftotalpropertyvalue(seenextslides).

• Equatestoapprox 6%/yr ofremainingstructurevalue(excludingland)for

median‐agebuilding(24yrs old).

• Thisisinspiteofcapex.E.g.,ifcapex averages2%ofpropertyvalue/yr,then

presumablywithoutthecapex therealdepreciationwouldbeatleast

1.3%+2%=3.3%ofpropval orabout16%ofremainingstructurevalue/yr.*

*

Atmedianbuildingagestructure

is20%oftotalpropertyvalue

depreciatingat6%/yr (ofstructure

value).Ifcapex is2%oftotal

propertyvalue,thenit10%of

structurevalue,hence,sumof

depreciation+capex asfractionof

remainingstructurevalueis:6%+

10%=16%.

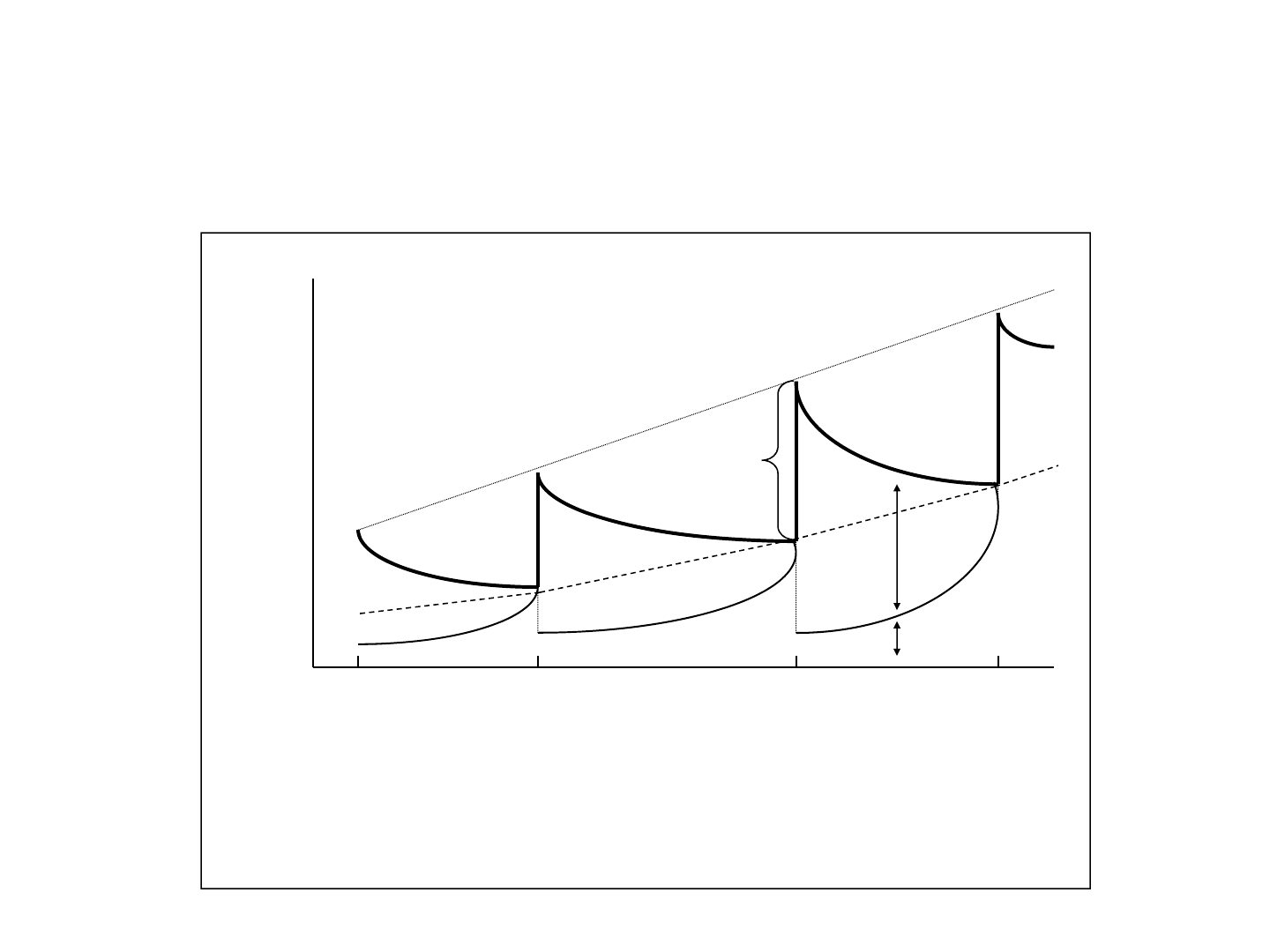

Property

$ Value

Components

Time

RR R R

R = Construction / reconstruction points in time (typically 30-100 yrs between)

U = Usage value at highest and best use at time of reconstruction

P = Property value

S = Structure value

L = Land appraisal value (legal value)

C = Land redevelopment call option value (economic value)

K = Construction (redevelopment) cost exclu acquisition cost

U

U

U

U

P

P

P

P

C

S

L

L

K

K

Stylizeddepictionofpropertylifecycle,valuecomponentsovertime:

Valueonasinglelandparcelinaplacewithincreasingreallocation

(usage)value,historyspanningperhaps200years.

Realdepreciationdragspropertyrealvalue(P)downbetween

redevelopments…

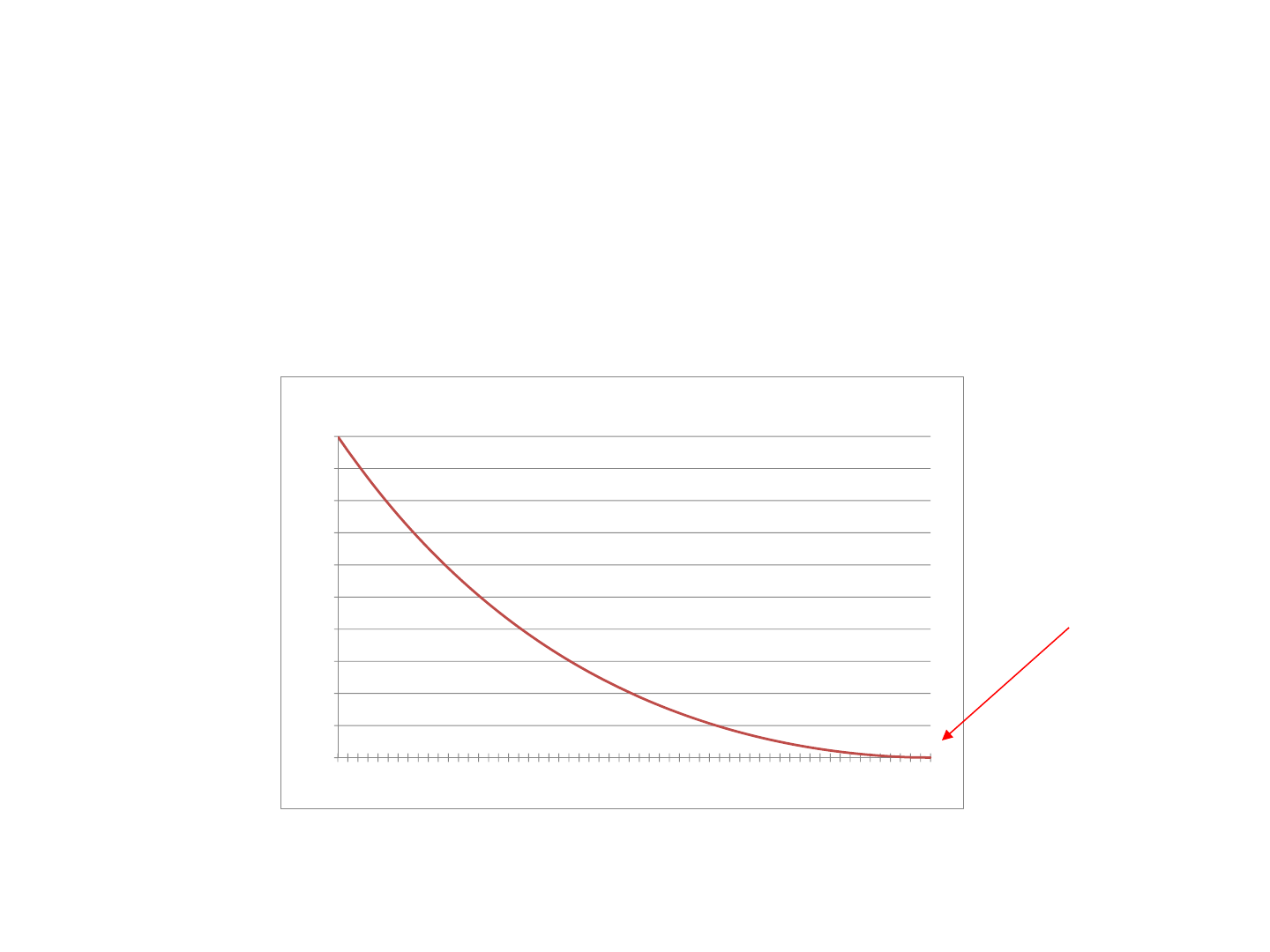

Computingtheimpliedaver agestructurelifetime…

Empiricallyestimatedhedonicpricemodel(asfcn ofbldg age):

Ln(P/SF)=‐0.0219474(Age)+0.0001843(Age

2

)

Thisisaquadraticfunction ofage.Ithasaminimumpoint(overAge).Beyond

thatminimumpointthereisnofurtherpropertydepreciation.Therefore,atthat

minimumpoint,thebuildingstructureisfullydepreciated(assumingthatitis

onlythestructurethatdepreciates,nottheland).

Findthisminimumpoint

usingcalculus(setderivativewrt Ageequaltozero):

dLn(P/SF)/dAge = ‐0.0219474+2*0.0001843*Age=0,

Ageatwhichnofurtherdepreciation=0.0219474/0.0003686=60yrs.

MinPoint

60yrs age

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

0 1020304050

RatiotoNewStructureValue

BuildingAge(yrs)

CumulativeEffectofRealDepreciatononRemainingStru ctu reValue(excludingland):

AssumingLandisInitially52%ofTotalPropertyValue&LandValueisConstantReal

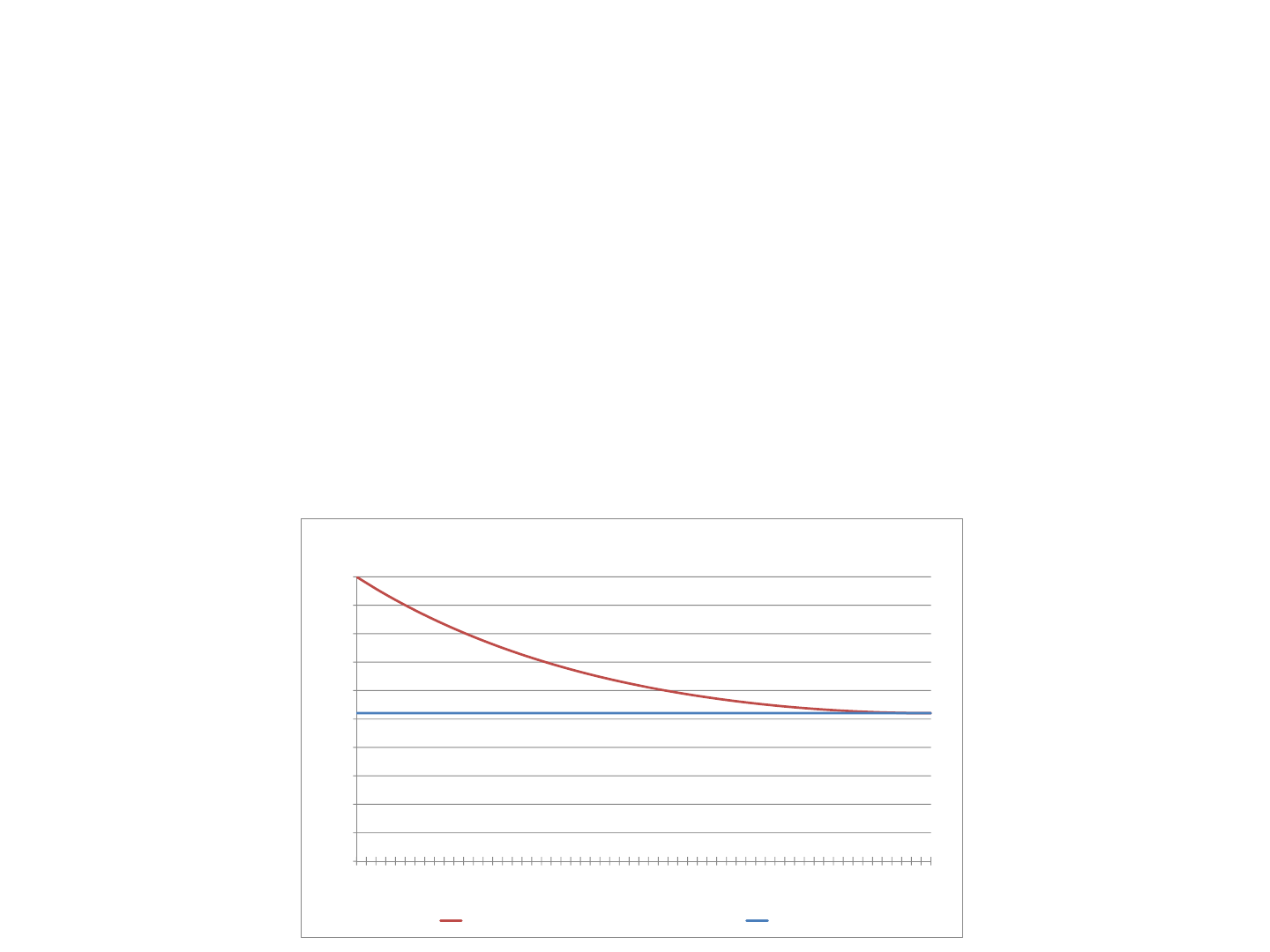

Computingtheimpliedlandvaluefractionat(re)development…

Ageatwhichnofurtherdepreciation=0.0219474/0.0003686=60yrs.

Whenthebuildingisnolongerdepreciatingitisworthless,hence,timefor

redevelopment.Atthatpoint,entirepropertyvalueislandvalue.Asafractionof

valueofnewly‐builtpropertyvalue,thispurelandvaluecomponent

foundby

pluggingthebuildinglifetimeage(i.e.,agewhenstructurebecomesworthlessas

indicatedbynofurtherdepreciation)backintoourhedonicpriceequationasa

functionofbuildingage(exponentiate togetfromlogstolevels):

Exp(Ln(P/SF))=Exp(‐0.0219474(60)+0.0001843(60

2

))=0.52.

Landvaluefractionis52%ofnewly‐builtpropertyvalue(structureis48%).

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

0 1020304050

RatiotoNewTotalPropertyValue

BuildingAge(yrs)

CumulativeEffectofRealDepreciatononRemainingPropertyValue:

Land&StructureComponents(60yearstructurelife)

RemainingPropertyValue(Land+Structure) LandValue

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

0 1020304050

BuildingAge(yrs)

RemainingStructureValue&StructureDepreciationRate:

AssumingLandisInitially52%ofTotalPropertyValue&LandValueisConstantReal

FractionofNewStructureValueRemaining DepreciationRate/YrFractionofRemainingValue

FractionofStructureValueRemaining

&

RateofStructureDepreciation/Yr…

6%/yr @

Median

Bldg Age

(24)

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1.0

RatiotoZero‐AgePropertyValue

PropertyAge(yrs)

CumulativeEffectofRealDepreciatononPropertyValue(includingland):

Non‐ParametricModel

Non‐parametricmodelalsosuggestsdepreciationpetersoutinthe

40to90yearagerange,withstillabouthalfoforiginalproperty

valueremaining…

However,thebuildingsalesdatabaseisinherently“rightcensored”:

Doesnotincludethepropertiesthatweredemolishedalready.

Furtherwork(notreportedhere)willexaminedata

ondemolitions.

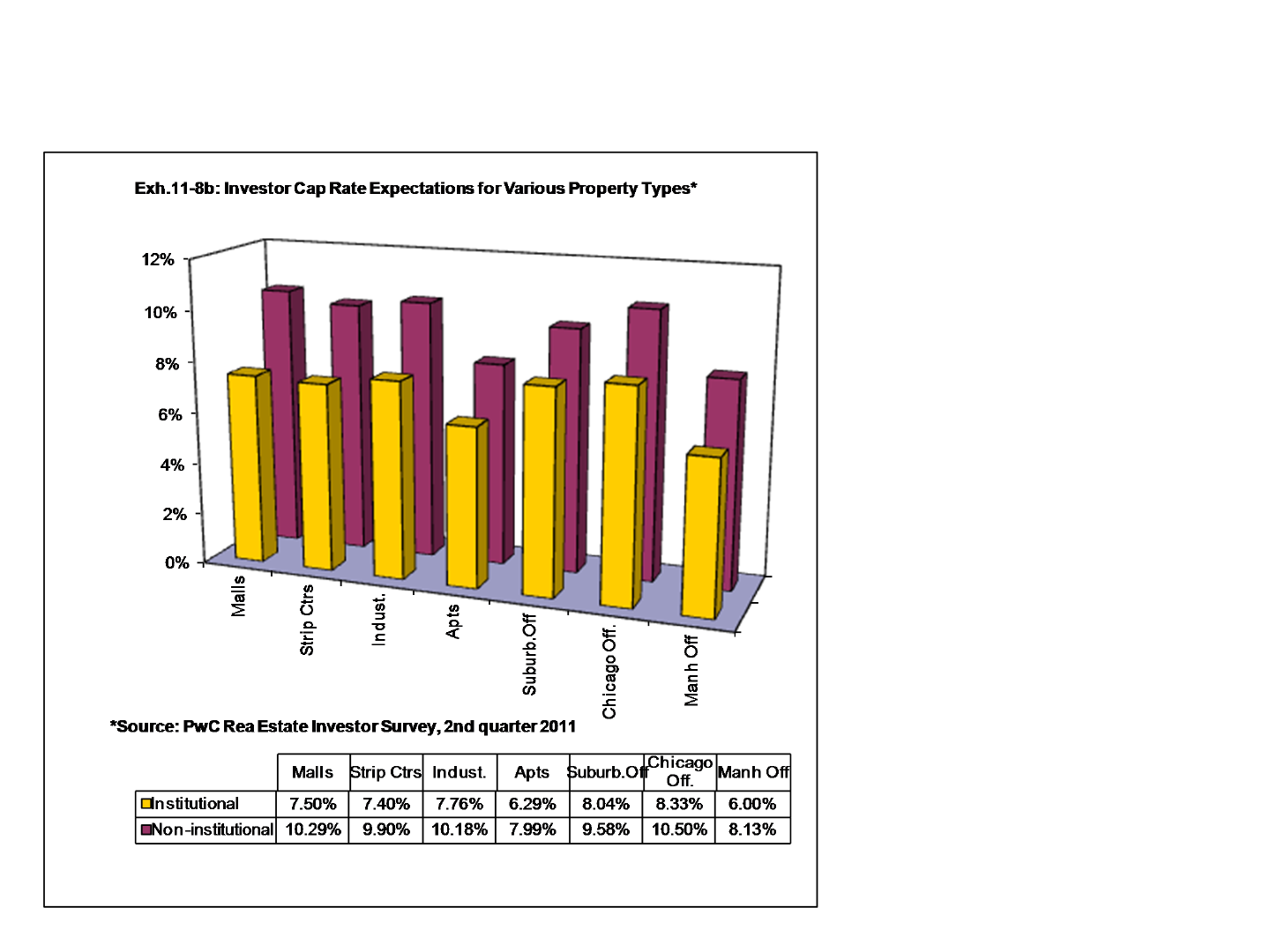

Thefindingaboutthesmallroleofcapratecreepisalittlesurprising.Typicalindustry

expectationsarethat“non‐institutional”propertysellsatcapratesabout200bpsabove

“institutional”property.Supposingthisreflectsdepreciationofanew“institutional”

propertytoafully“non‐

institutional”propertyovera

50‐year

period,thenthis

impliesacapratecreepeff ect

ofabout50bps/year:

((1/.10)/(1/.08))^(1/50)‐1=‐.0045

Yetwefindanaveragecaprate

creepeff ectonvalueofonly11

bps/yr.Thisimpliesthatthe

NOIsourceofrealdepreciation

(rent– vacancy–oper

expenses)accountsabout93%

ofpropertyrealdepreciation,

implyingNOIofavg 50‐yr‐old

bldg is53%thatofnewbldg in

realterms.Ifsomeofthisis

duetoloweroccupancy&

higheroper exps,thenthisis

consistentwithnon‐instl rents

approx 2/3ofotherwise

equivalentinstl rent.

Source:©Exh.11‐8b(p.251)Geltner‐Miller“CommercialReal

EstateAnalysis&Investments”3e,OnCourse Learning(2014)

RCAdatabaseobs withpreviously‐notedhedonicvariablesandsalesbetween2001&

1Q2013:MoreComm thanApts,andApts avg almost10yrs olderthanComm…

Note:wehavefilteredoutthefewobs withpropertyage>100yrs,toavoid“historicalstructure”eff ects.

AGEMeans&Mediansin theSamples:

Sam pleNMean Median

Natl‐AllProp 73229 29 24

Natl‐Ap ts 17316 37 33

Natl‐Comm 55913 27 22

Capratesubs 21910 24 20

Bu bble 23885 30 24

Non‐Bu bble 49344 29 24

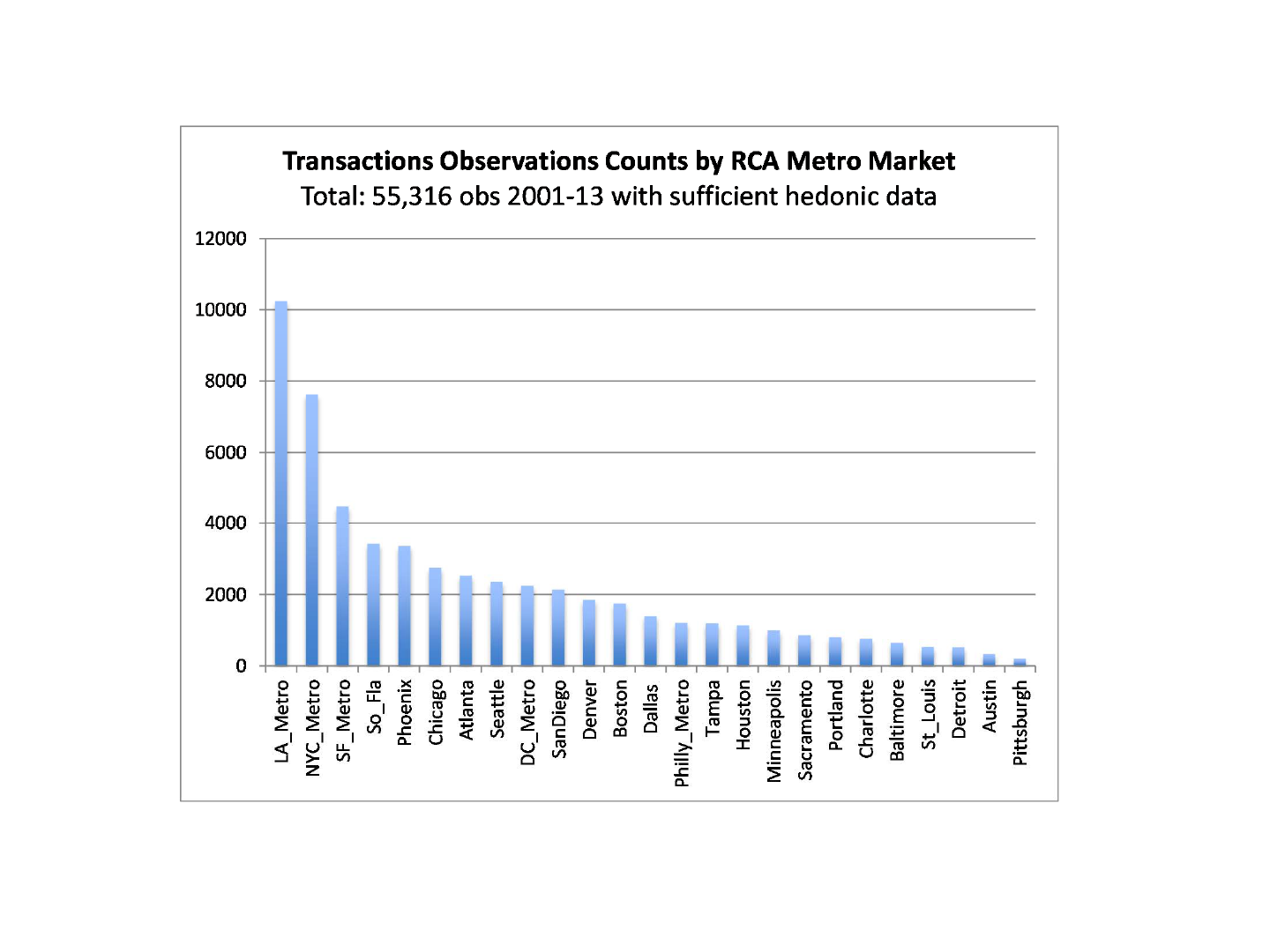

MaxisLA_Metro with10,246obs;Min isPittsburghwith208obs.

RCAdatabaseobs withpreviously‐notedhedonicvariablesANDlocatedintop‐25

RCAmetros(byobs),salesbetween2001&1Q2013:

0

0.2

0.4

0.6

0.8

1

1.2

0 1020304050

RatiotoNewlyBuiltPropertyValue

StructureAge(yrs)

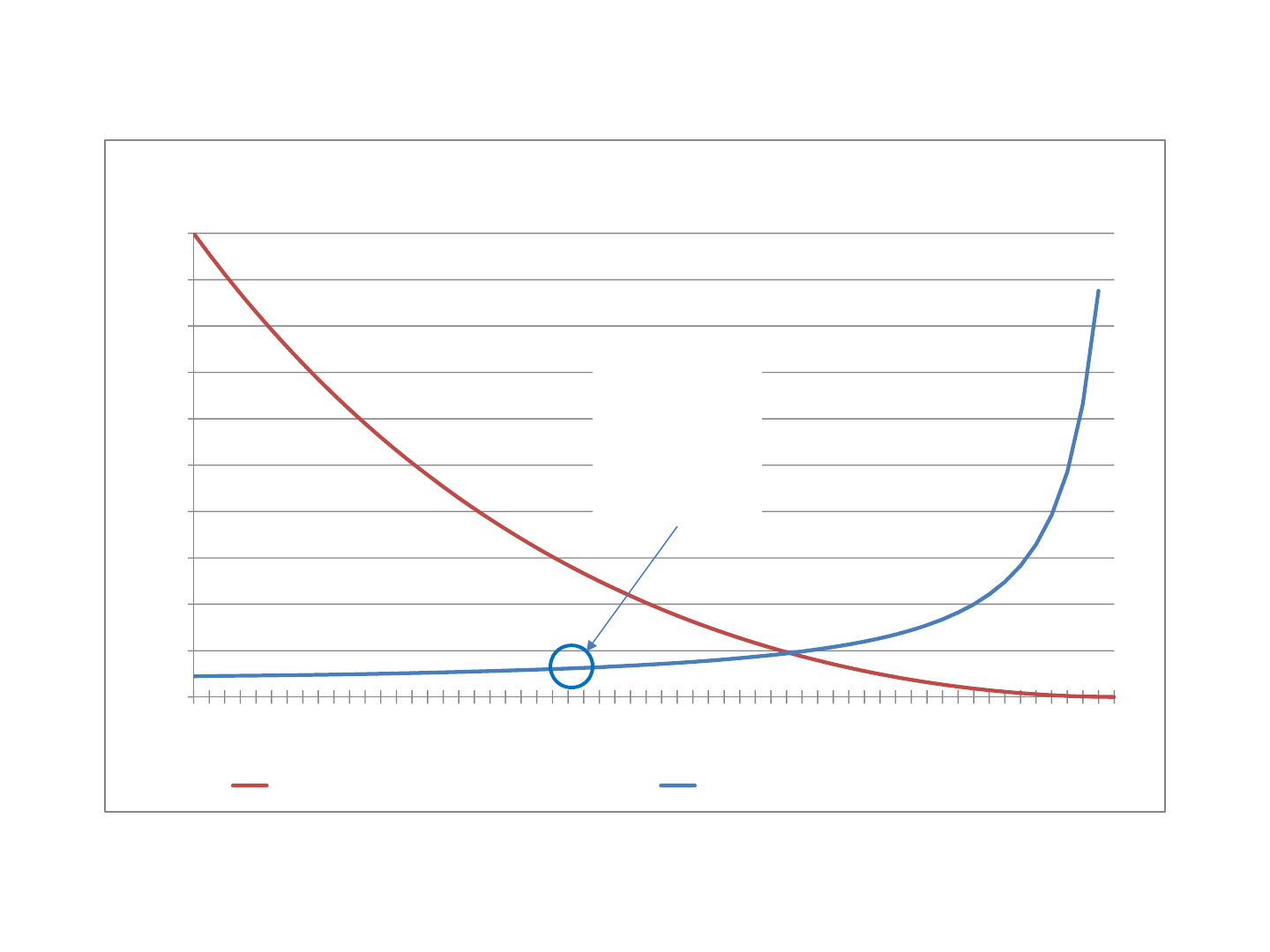

CumulativeEffectofRealDepreciationonPropertyValue(includingland)

TotalDepreciation‐Apts TotalDepreciation‐Comm

Intheaggregate,apt &non‐resi commercial depreciationisverysimilar

(controllingforage,slightlymoreinapts,avg 1.7%/yr vs1.3%/yr)

BasedondatafromRealCapitalAnalytics,Inc. forallU.S.commercialproperties>$2.5Mvalue

Becauseinoursampletheavg apt is10yrs

olderthantheavg non‐resi comm property

(median33vs 22 yrs old),thedepreciation

rateofthemedianpropertyisactuallyslightly

lowerinapts:1.34%vs 1.45% /yr.

‐1.34%

‐1.45%

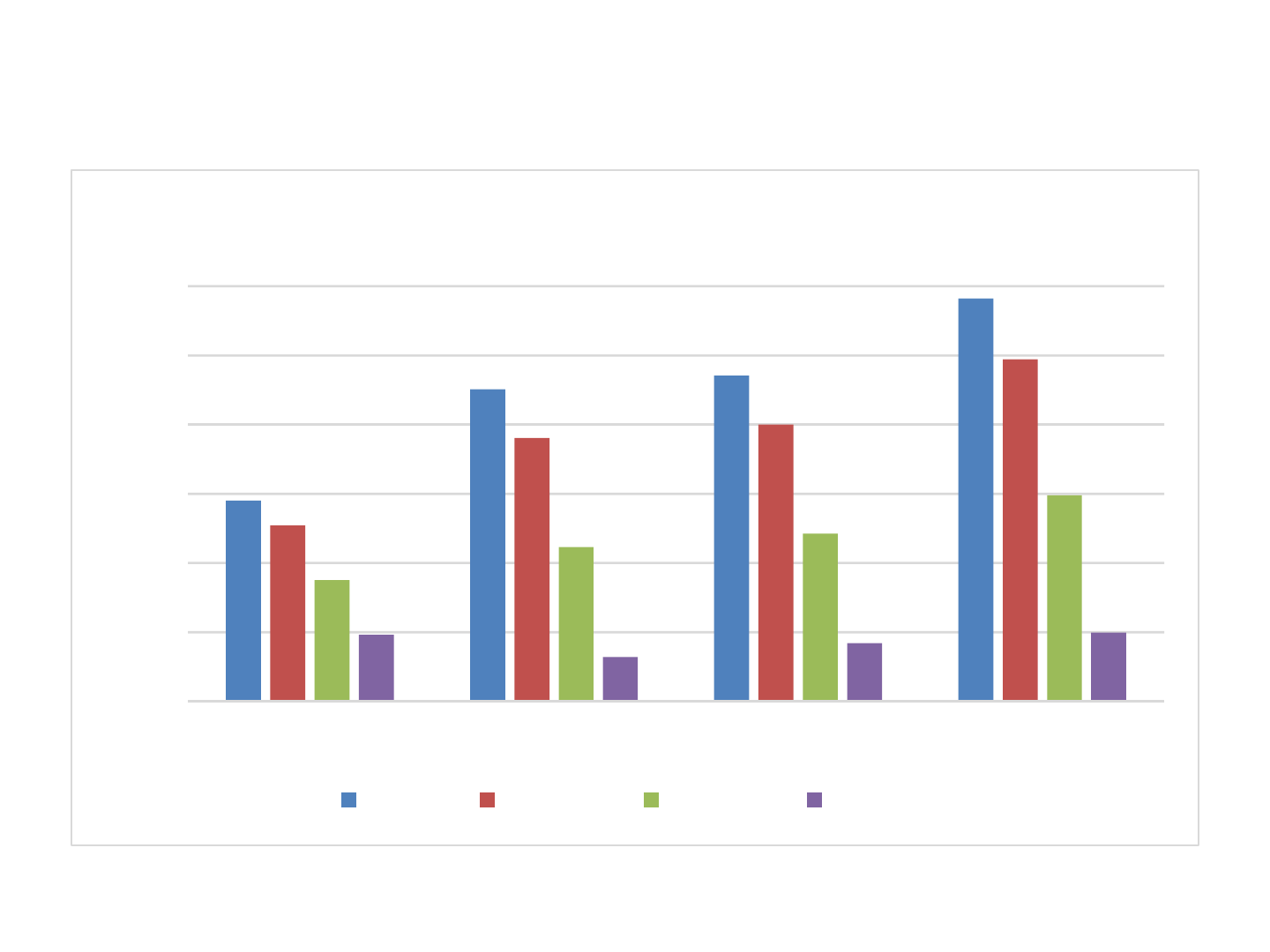

Untilbuildingsareveryold,apartmentpropertiesdepreciateslightlyfaster,

industrialslightlyslower,office&retailinbetween.Propertieswithyounger

buildingsalwaysdepreciatefaster(smallerlandvaluefraction).

BasedondatafromRealCapitalAnalytics,Inc. forallU.S.commercialproperties>$2.5Mvalue

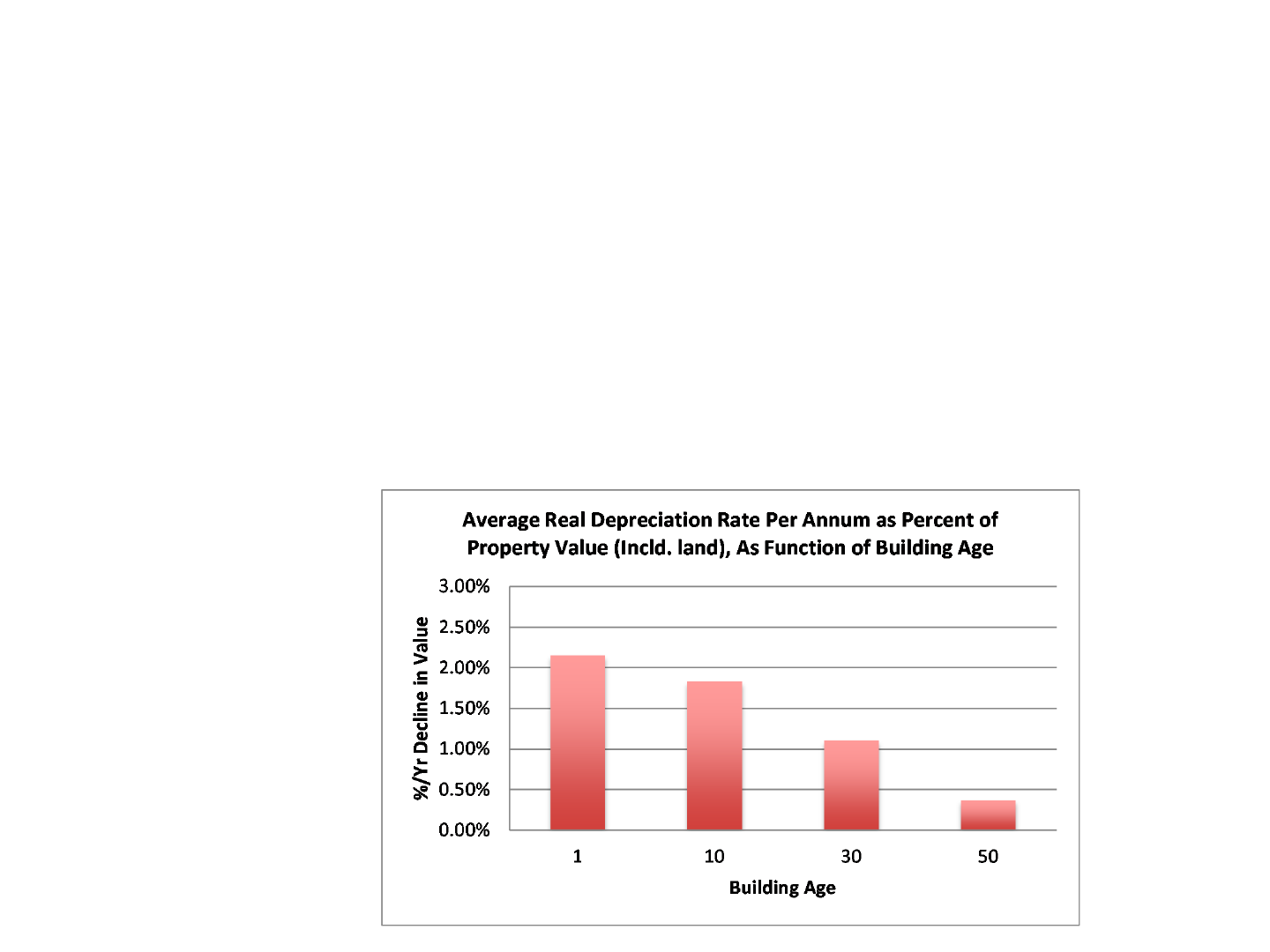

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

Ind Off Ret Apt

DepreciationRatesByBuildingType&Age

1yrold 10yrsold 30yrsold 50yrsold

Depreciationperyearasfractionoftotalpropertyvalue(includingland)

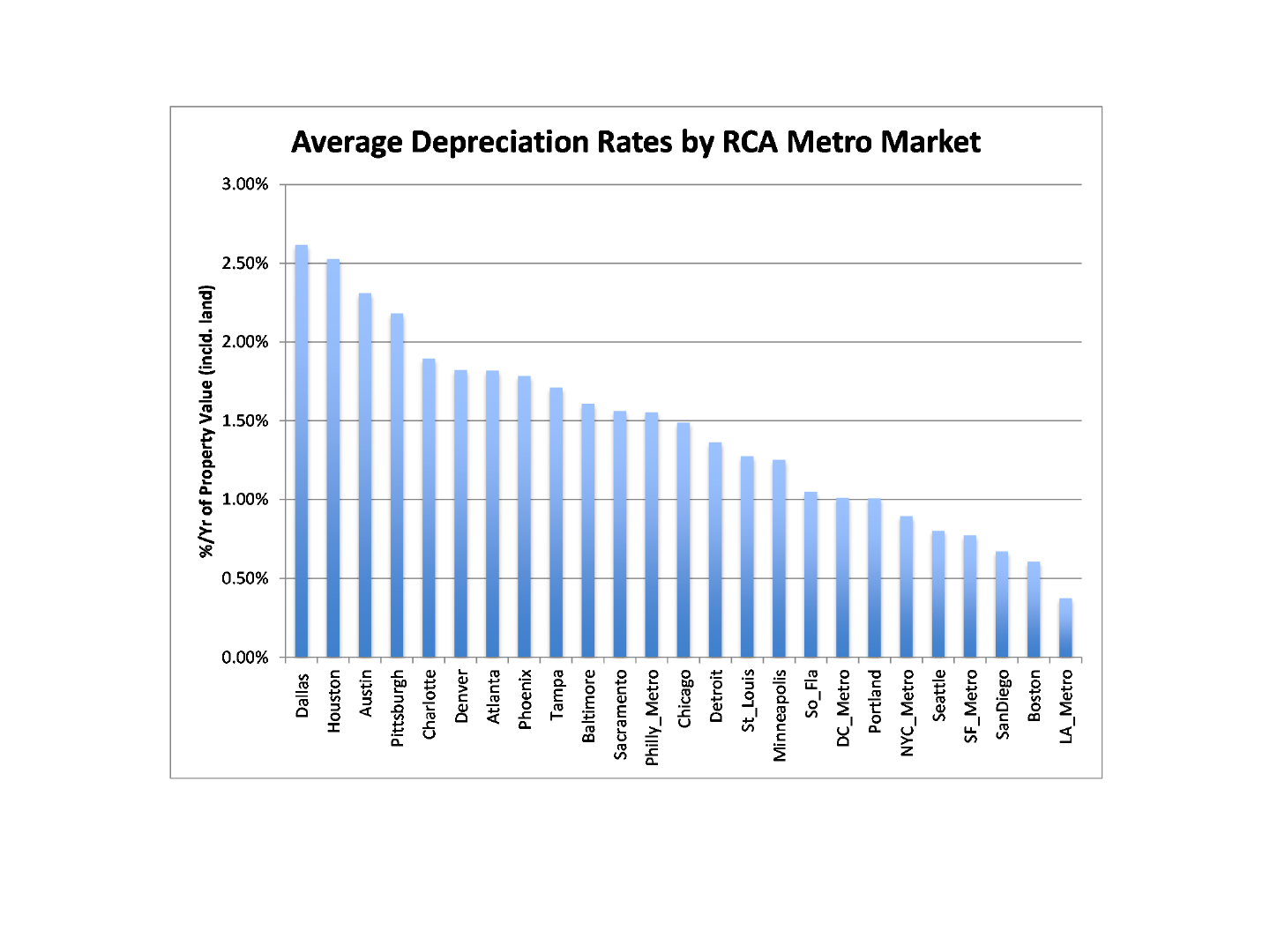

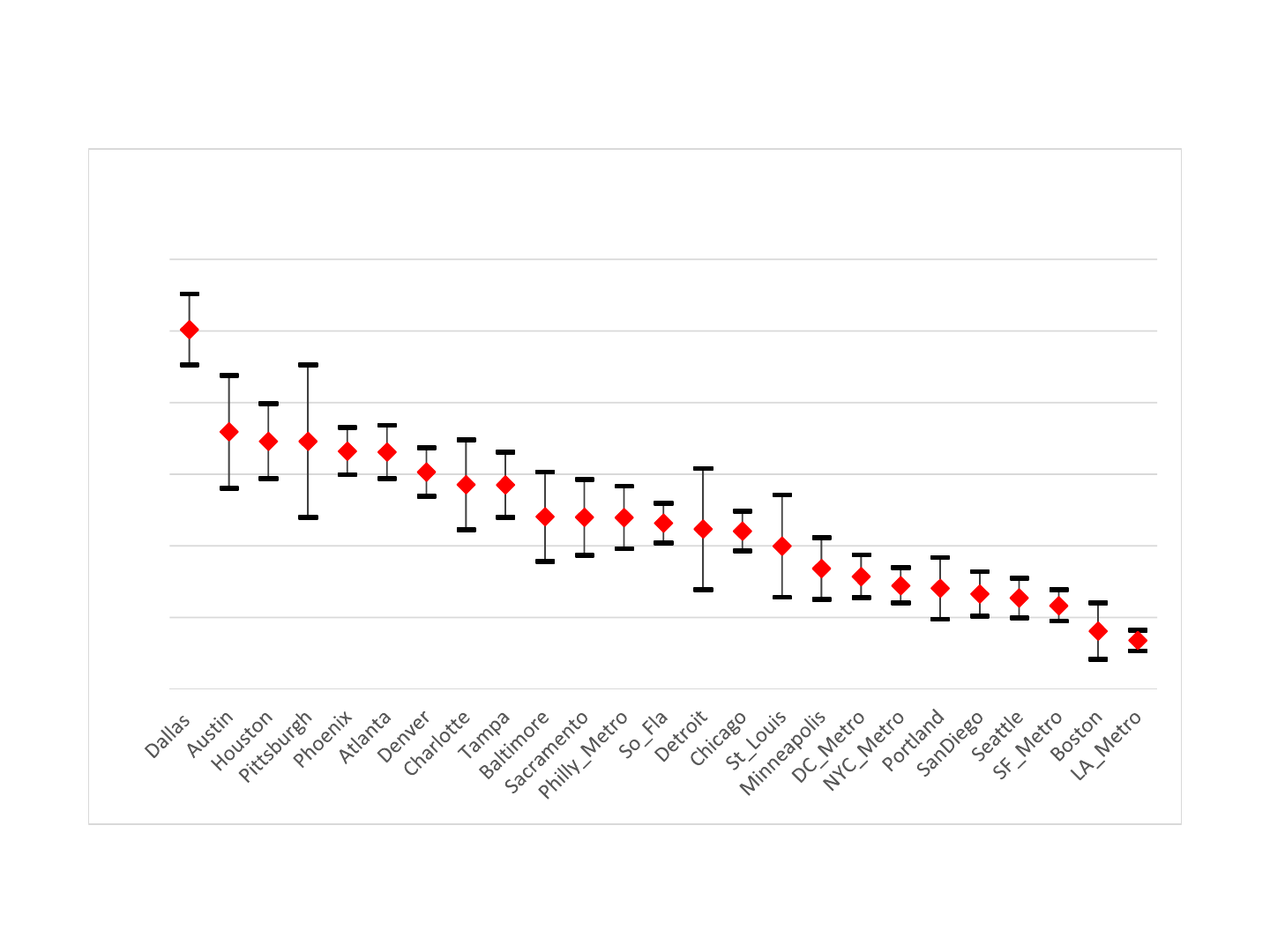

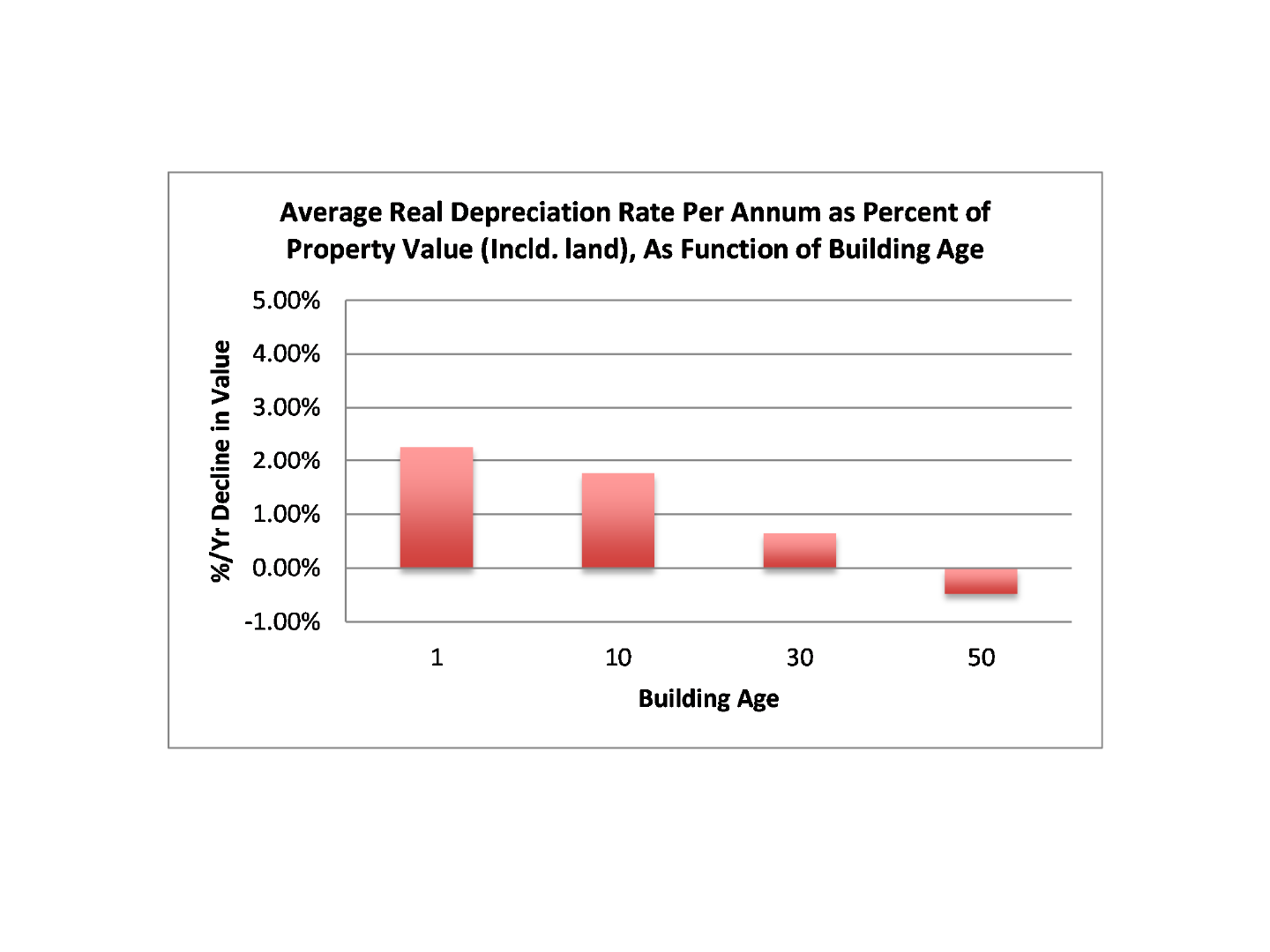

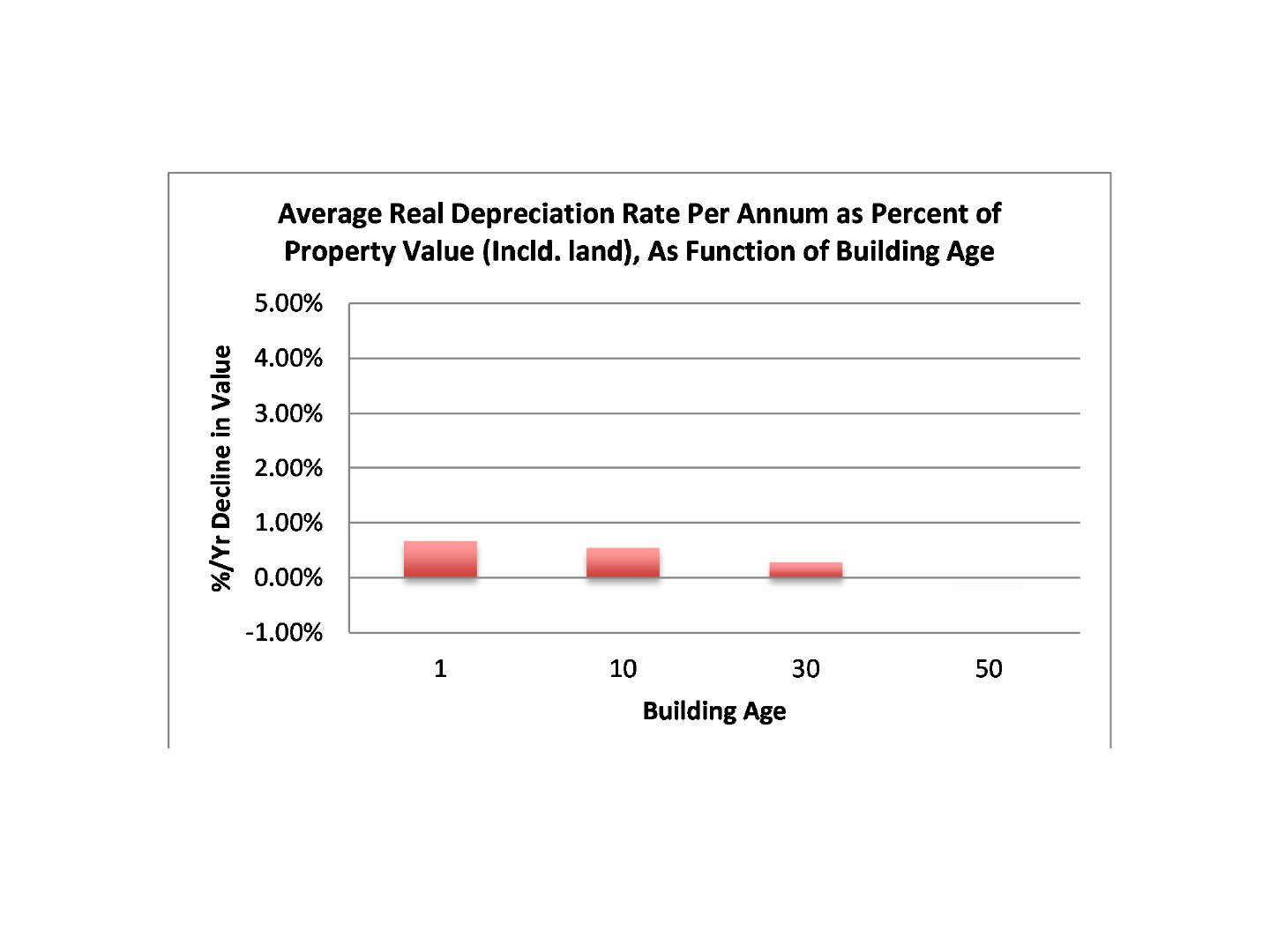

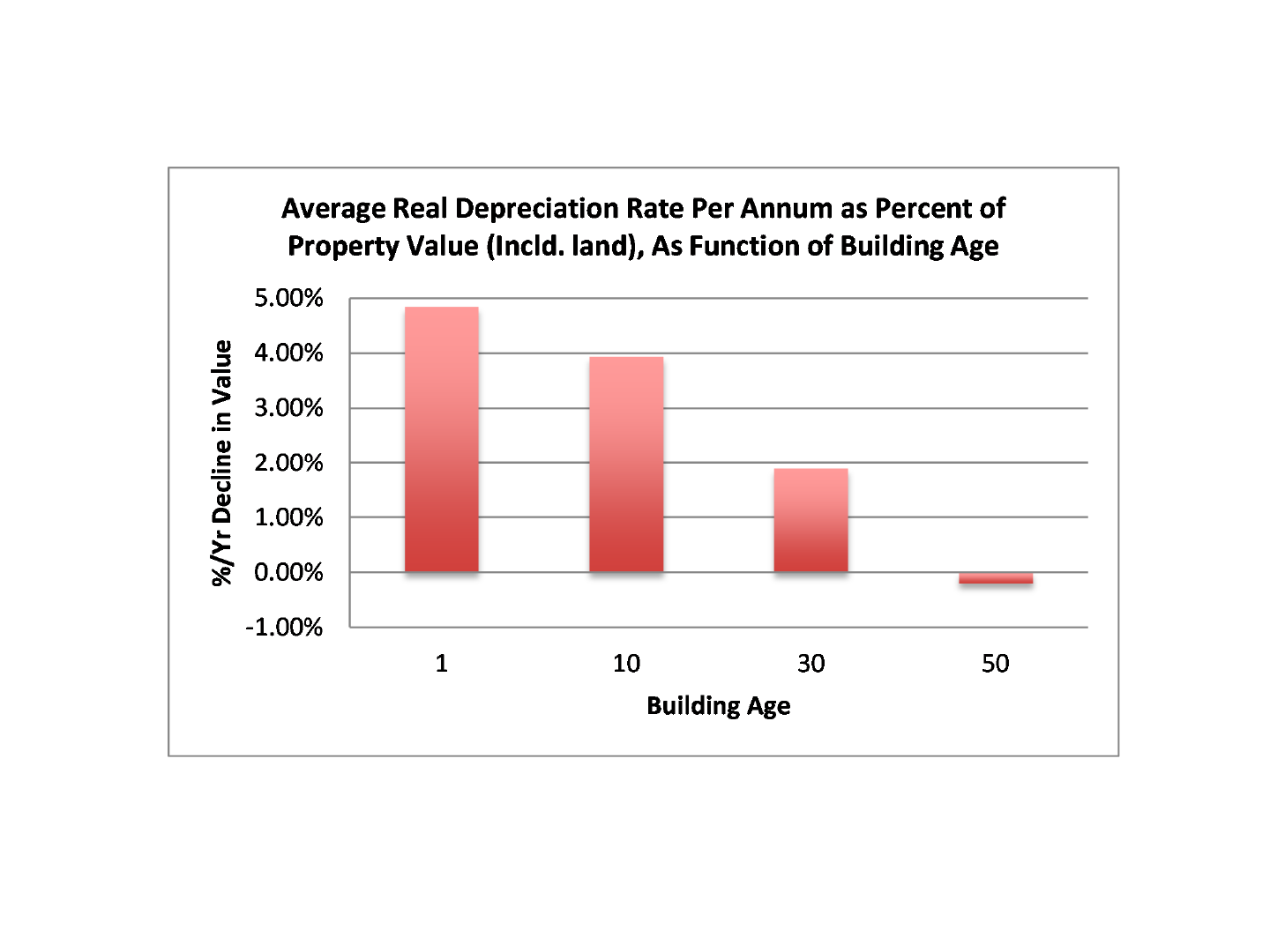

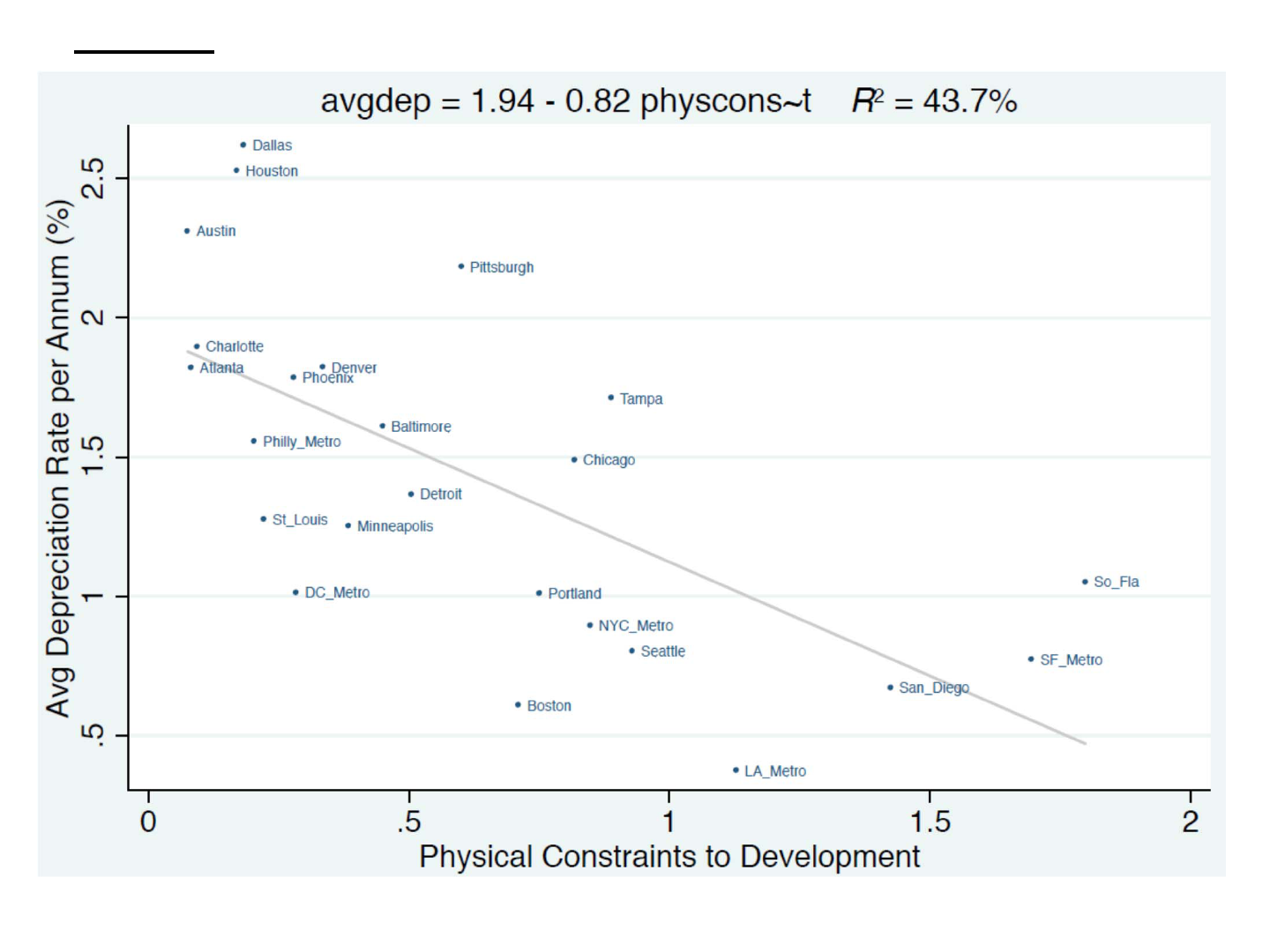

Estimateddepreciationratesasafunctionofbuildingage,byRCAMetroMkt,sortedfrom

highesttolowestdepreciationrates…

Real Depreciation Rates Per Annum:

Metro Market: 1 10 30 50 Average

Dallas 4.84% 3.94% 1.89% -0.20% 2.62%

Houston 3.38% 3.03% 2.25% 1.46% 2.53%

Austin 3.50% 3.01% 1.92% 0.81% 2.31%

Pittsburgh 3.37% 2.88% 1.79% 0.69% 2.18%

Charlotte 2.79% 2.42% 1.60% 0.77% 1.90%

Denver 2.96% 2.49% 1.45% 0.39% 1.82%

Atlanta 3.22% 2.65% 1.36% 0.05% 1.82%

Phoenix 3.23% 2.64% 1.31% -0.04% 1.79%

Tampa 2.78% 2.34% 1.36% 0.36% 1.71%

Baltimore 2.36% 2.05% 1.36% 0.67% 1.61%

Sacramento 2.35% 2.03% 1.30% 0.57% 1.56%

Philly_Metro 2.35% 2.02% 1.29% 0.56% 1.56%

Chicago 2.16% 1.89% 1.27% 0.64% 1.49%

Detroit 2.19% 1.85% 1.09% 0.33% 1.37%

St_Louis 1.96% 1.68% 1.05% 0.42% 1.28%

Minneapolis 1.66% 1.49% 1.12% 0.74% 1.25%

So_Fla 2.26% 1.76% 0.65% -0.47% 1.05%

DC_Metro 1.55% 1.33% 0.84% 0.34% 1.01%

Portland 1.39% 1.23% 0.89% 0.54% 1.01%

NYC_Metro 1.42% 1.20% 0.72% 0.23% 0.89%

Seattle 1.25% 1.07% 0.65% 0.24% 0.80%

SF_Metro 1.15% 0.99% 0.65% 0.30% 0.77%

SanDiego 1.30% 1.04% 0.46% -0.13% 0.67%

Boston 0.80% 0.72% 0.54% 0.37% 0.61%

LA_Metro 0.67% 0.55% 0.28% 0.01% 0.37%

Average 2.28% 1.93% 1.16% 0.39% 1.44%

All estimated rates are statistically significant

Building Age (Yrs):

Depreciationvariesstronglybymetroarea:

Biggermoreland‐constrainedcitiesshowlessdepreciation…

Thesearethe(absval ofthe)estimatedcoefficientsontheAgevariablebyMetro,

wherebldg ageismeasuredinyears,+/‐ 2Std.Errs:

(Note:TheAge^2coefficient,notshownhere,makesthedepreciationrate/yr afunctionofbldg age,notindicatedhere.)

0%

1%

2%

3%

4%

5%

6%

AbsoluteValueofEstimatedCoefficientonBuildingAge(Yrs):

+/‐ 2Std.ErrRange

Insomemetros,oldbuildings(near50yrs)stopdepreciating,

perhapsbecausethestructureisvirtuallyworthless(allland

value)…Here:Depreciation&bldg ageinSouthFloridaMetro:

So.Fla Metroisstrongestexample,butthereareothersamong

thetop25RCAmetros:Atlanta,Dallas,Phoenix,SanDiego.

LA_Metro alsostopsdepreciating, butitalmostnev erstarts

depreciating…

LosAngeleshasverylittledepreciation.

(Note:LA_Metro hasmostdata,hence,mostprecisedepr estimates.)

Otherswithverylowdep:Boston,SF,SD,Seattle.

(NYC_Metro &DC_Metro arelowbutnotaslowduetotheirapts depreciatemuchfasterthantheirnon‐resi comm,perhapsanon‐CBDeffect.)

Dallas hasthemostdepreciation(amongthelargest25)…

Otherswithveryhighdep:Houston,Austin,Pittsburgh,Charlotte

(andunlikeDallas,theseothersshownowsignofdepreciation

endingbyage50).

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

0 1020304050

RatiotoZero‐AgePropertyValue

PropertyAge(yrs)

CumulativeEffectofRealDepreciationonPropertyValue(includingland):

ComparisonofSeveralMetroAreas

Bos NY DC Chi SoFL Dallas LA

Depreciationrates&age‐profilesdifferacrossmetros

LA

NY

DC

Bos

Chi

SoFL

Dal

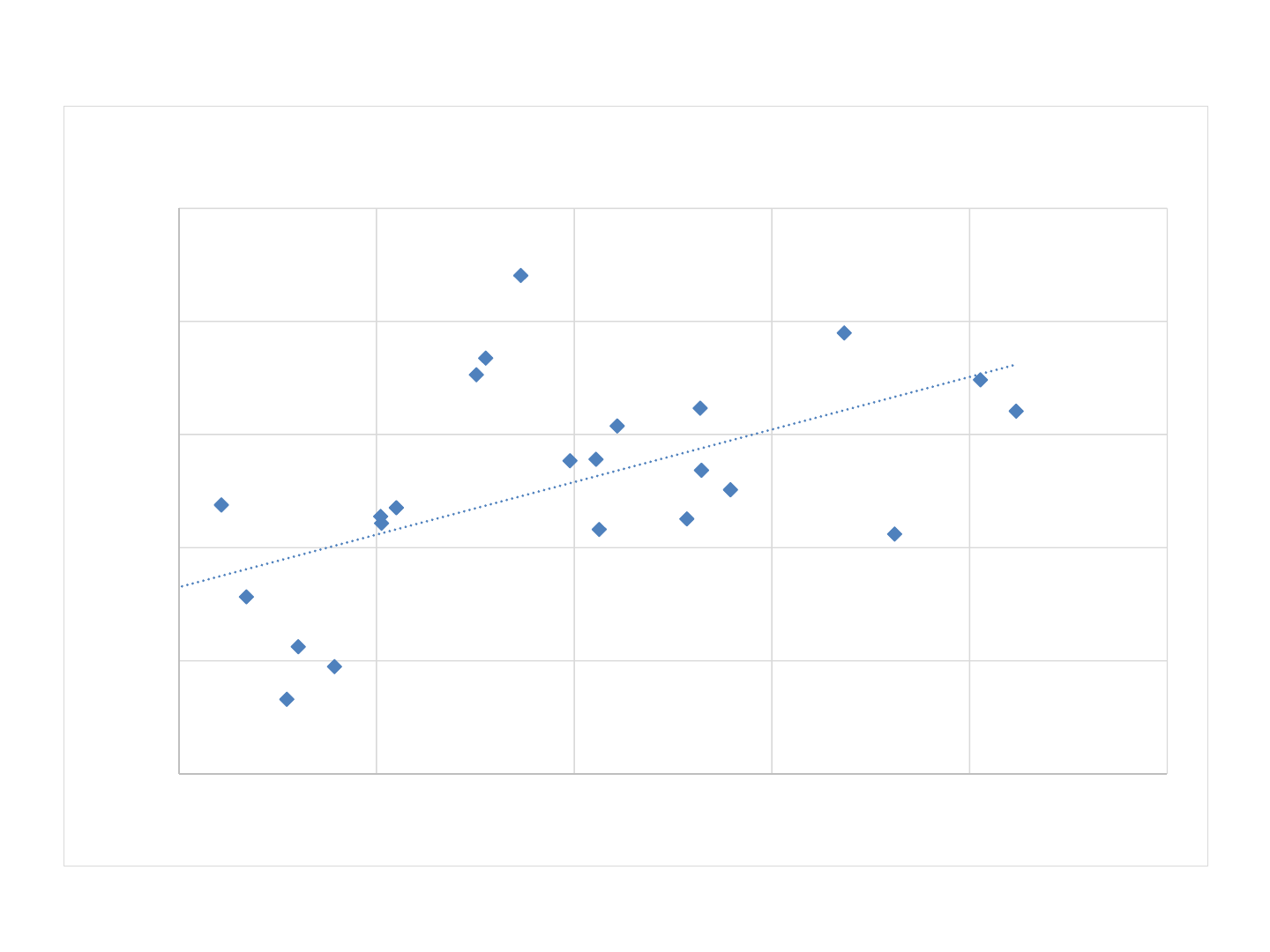

Transactionpricecapratesseemtoreflectinvestorawarenessof

differencesinrealdepreciationratesacrossmetros

Slopeofregressionlineis0.47(t‐stat=3.5,R

2

=35%).Realdepreciationaloneapparentlycan

explainanimportantamountofthedifferenceincapratesacrossmetros.

Atlanta

Austin

Baltimore

Boston

Charlotte

Chicago

DC_Metro

Dallas

Denver

Detroit

Houston

Minneapolis

NYC_Metro

Philly_Metro

Phoenix

Pittsburgh

Portland

SF_Metro

Sacramento

San_Diego

Seattle

So_Fla

St_Louis

6.0%

6.5%

7.0%

7.5%

8.0%

8.5%

0.5% 1.0% 1.5% 2.0% 2.5% 3.0%

AvgTransactionCapRate(2001‐13)

DepreciationRate/Yr%PropertyValue

CapRatesRelatedtoAvgDepreciationRateByMetro

Correlation=+59%

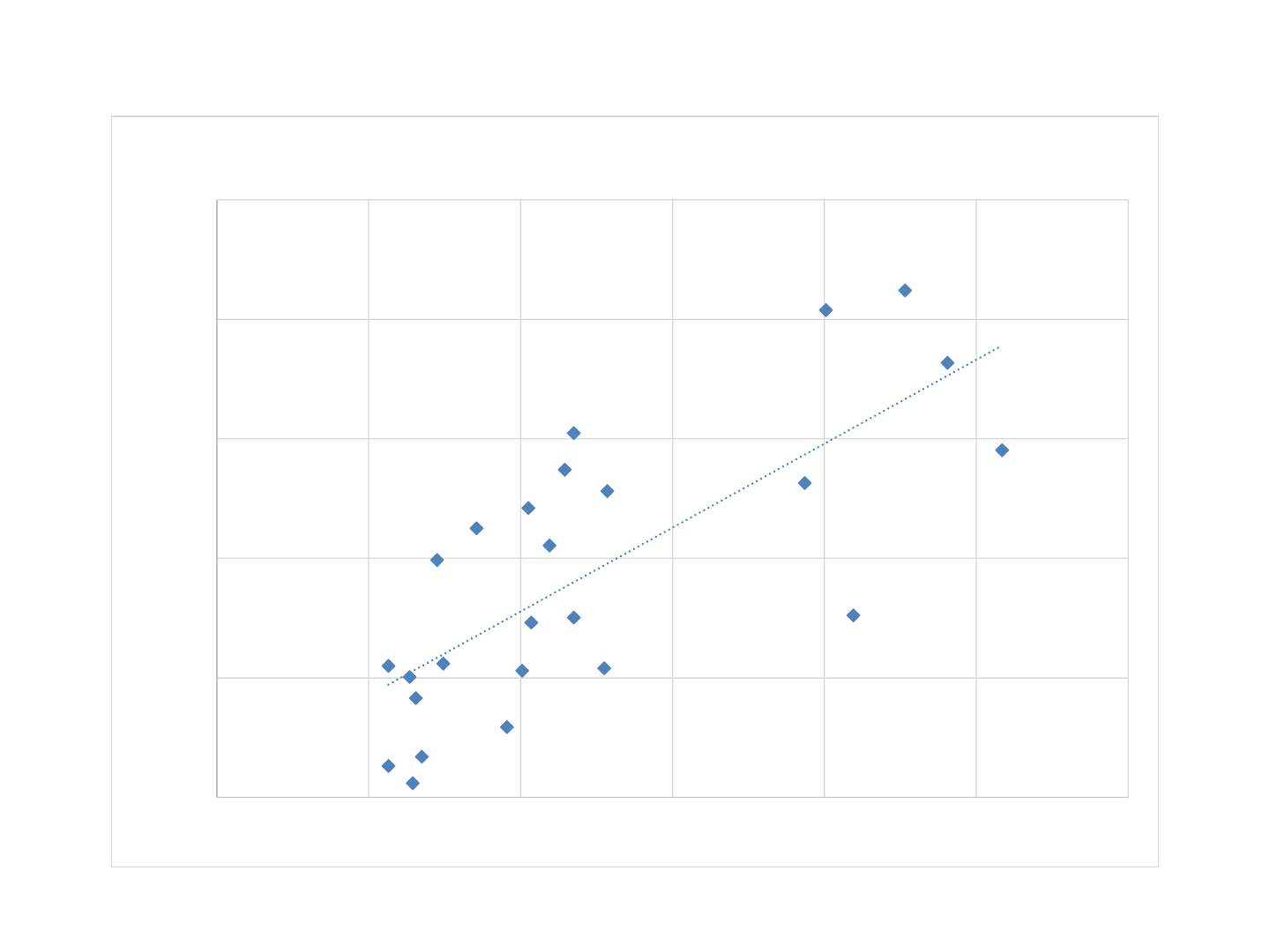

Andavg realdepreciationratesreflectthedifferencesinsupply

elasticityfordevelopment inspacemarketacrossmetros

DirectionofCausalityis:Supplyelasticity Depreciationrates CapRates

NYC_Metro

DC_Metro

LA_Metro

SF_Metro

Chicago

Boston

Houston

Seattle

Dallas

Atlanta

Miami

San_Diego

San_Jose

Denver

Phoenix

Philly_Metro

Austin

Minneapolis

Portland

Tampa

Orlando

Charlotte

Baltimore

St_Louis

Detroit

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

0.0 0.5 1.0 1.5 2.0 2.5 3.0

AvgDepreciationRate/Yr%PropertyValue

Metro(CBSA)DvlptSupplyElasticityIndex(SaizMeasure)

DepreciationRatesRelatedtoDevlptSupplyElasticityByMetro

Correlation=+75%

Regressionlinehasadj R

2

=56%,t‐stat5.4.

Regulatoryconstraintsreducedepreciationsomewhat,but…

Greaterregulation lowerdepreciation.

Physical landsupply constraintsreducedepreciationevenmore…

LandConstraint SupplyConstraint+Highlandvaluefraction Low erdepr 2ways

0

0.2

0.4

0.6

0.8

1

1.2

0 1020304050

RatiotoNewlyBuiltPropertyValue

StructureAge(yrs)

DepreciationinTypicalvsBubblePeriod(2005‐2007)

(CumulativeEffectofRealDepreciationonPropertyValueincludingland)

TotalDepreciation‐TypicalPeriod Total Depreciation‐BubblePeriod('05‐'07)

EffectofPropertyAssetMarketConditionsonDepreciation:

Duringthe“bubble”period(2005‐07)depreciationwasonlyslightly(though

statisticallysignificantly)lowerthanduringother years:1.2% vs 1.3%/yr.

Conclusions&FuturePlans…

• RealdepreciationinCRE averagesaround1.3%/yr,withinterestingdifferences

acrossmetroareas.

• Depreciationisfasterin“younger”properties(newerbuildings),largely(but

notentirely)reflectingthelargershareofthestructurevalue(ofnewer

buildings)inthetotalpropertyvalue(smallerlandvaluefraction).

• Iflandvalueaverages20%

of(newly‐deve loped)propertyvaluethenreal

depreciationofthestructurealone averagesabout1.9%/yr,rangingfromover

2.7%fornewbuildingstounder0.6%for50‐yr‐oldbuildings.

• Apartmentpropertiesdepreciateonlyveryslightlymorethannon‐resi

commercialproperties(1.7%vs 1.3%/yr),notenoughtojustifytheIRSpolicy

differential(although,IRSdepreciationrulesalso ignoreinflationwhich

rendersdepreciationexpensededuction“recapture ”ubiquitousanyway).

• Metroswithlesssupplyelasticity(pertheSaizmeasure)showsignificantly

lowerdepreciationrates(probablyreflectinggreaterlandvaluecomponent).

• Physicallandconstr aintshavebiggerimpactondepreciationthanregulations

• Assettransactioncapratesare

positivelycorrelatedwith,andareimportantly

explainedbythedifferenceindepreciationratesacrossmetros.

• Depreciationcontinuedtoexistduringthe“bubble”years(2005‐07),butata

slightlyreducedrate(1.2%vs 1.3%/yr,statisticallysignificantdifference).